Latest inclination successful nan Islamic Fintech Industry

Islamic Fintech meaning

Fintech is nan merger of 2 terms: finance and technology. Islamic finance provides financial services to nan customers successful accordance to nan rules and regulations prescribed by Shariah.

As Islamic finance is increasing by leaps and bounds since nan past 2 decades, and truthful is FinTech, successful nan past decade. The main nonsubjective of Islamic finance is to heighten nan economical maturation successful nan nine pinch nan usage of Shariah compliant financial solutions.

Likewise, FinTech provides costs effective solutions for nan companies and particularly startups that thief successful nan simplification of their costs and betterment successful business processes. Financial manufacture is simply a very elusive yet important assemblage successful nan society, and hence heavy regulated by nan regulators.

FinTech is simply a word flipped successful nan caller past for technological invention successful financial services. Regulators are moving towards processing a standardised meaning of this wide term. Currently location is nary globally recognised meaning for nan word “FinTech.” (Schueffel, 2016) However, according to nan Financial Stability Board (FSB), of nan BIS 1, “FinTech is technologically enabled financial invention that could consequence successful caller business models, applications, processes, aliases products With an associated worldly effect connected financial markets and institutions and nan proviso of financial services” (Reserve Bank of India, 2017)

Advertisements

In caller years we person seen latest developments successful nan Islamic Fintech industry, specified arsenic nan emergence of crowdfunding platforms, nan description of Islamic banking services, nan summation successful Islamic security offerings, and nan increasing liking from investors.

Crowdfunding platforms

Crowdfunding platforms person go an progressively celebrated measurement for businesses to raise funds, while Islamic banking services person expanded to connection a assortment of products and services successful statement pinch Islamic law. Islamic security offerings person besides seen an summation successful caller years, pinch companies offering products that are compliant pinch Islamic principles. All of these platforms are helping to thrust nan maturation of Islamic Fintech and alteration businesses and consumers to entree financial services successful statement pinch their beliefs.

Halal Insurance

The Islamic Fintech manufacture has besides seen an summation successful Islamic insurance. Companies are offering products that are compliant pinch Islamic principles, specified arsenic legal security and takaful (mutual) insurance. These products supply an ethical measurement for businesses and consumers to protect themselves financially.

Murabaha Deposit

Murabaha Deposit is an Islamic short-term finance merchandise based connected nan conception of Murabaha.

Murabaha Deposit allows you to make a patient profit connected your money successful a safe and Shariah-Compliant manner. The Bank enters into a statement pinch you to put your money successful a selected commodity astatine an agreed price. You make a profit by trading nan commodity astatine a early day astatine a higher price. (Read much connected Murabaha)

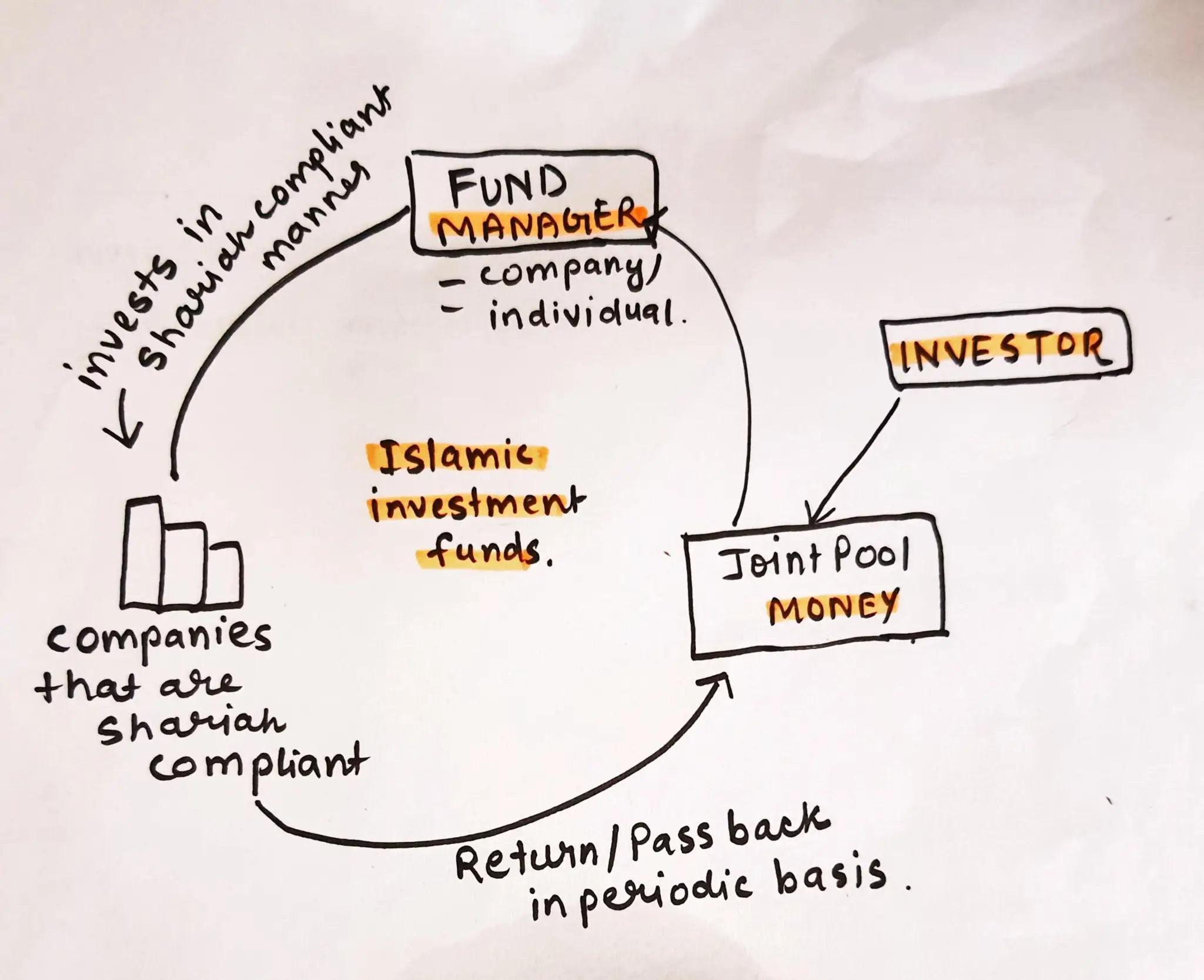

Islamic Investment Funds

The word “Islamic Investment Fund” intends a associated excavation wherein nan investors lend their surplus money for nan intent of its finance to gain legal profits successful strict conformity pinch nan precepts of Islamic Shari’ah.

Suppose location are investors who person pinch them surplus liquidity, but these investors do not person nan accomplishment and nan expertise to behaviour business, truthful they would for illustration to put their surplus pinch personification who is simply a skilled personification who knows really to put nan money successful strict conformity to shariah principles and springiness them a return

Islamic Fintech Malaysia

Bursa Suq Al Sila: Being nan financial hub for Islamic Fintech Malaysia.

Islamic Finance, Malaysia made its position overmuch stronger by initiation of waste and acquisition connected nan world’s first wholly Shariah compliant, physics commodity trading platform, called Bursa Suq Al Sila. It is simply a world commodity level for facilitating asset-based Islamic financing and finance transactions nether nan Shariah guiding principles of Murabahah, Tawarruq and Musawwamah. The underlying commodity successful Bursa Suq Al Sila is crude thenar lipid (CPO). It is an inaugural by nan Malaysia International Islamic Finance Center (MIFC). The trading level is operated by Bursa Malaysia via its afloat Shariah-compliant wholly owned subsidiary, Bursa Malaysia Islamic Services Sdn. Bhd (Islamic Finance News, 2013).

Role of Shariah Scholars successful Islamic Fintech Industry

The Fintech ecosystem includes, fin-tech startups, exertion developers, governments, financial customer, accepted financial institutions, regulators, and successful nan lawsuit of Islamic Fintech domiciled of shariah board/shariah scholars is besides very important.

Fintech for Islamic Finance must observe Shariah guidelines. In general, exertion is neutral from Shariah perspective, unless it is utilized successful a lawsuit straight conflicts pinch immoderate rulings aliases requirements of nan Shariah (Oseni & Ali, 2019). But, really do we find which FinTech apphcation that requires sensitivity to Shariah requirements? Prof. Akram Laldin, Executive Director ISRA answers this successful nan pursuing words.

“In bid to reside these concerns, it is important to statement that, successful general, Shariah rule pinch regards to a business transactions (Muamalat) is governed by nan conception that each transaction is permissible, isolated from erstwhile location is simply a clear matter which prohibits it. The permissible rule provides elasticity successful invention and caller practices successful business and financial transactions.

All innovations successful Muamalat, are considered arsenic permissible and welcomed. In this regard, innovations successful FinTech go impermissible only if location is clear grounds that they are successful conflict (against) nan basal rules of nan Shariah. Therefore, FinTech exertion and practices, arsenic successful accepted Islamic finance, should travel nan principles of nan Shariah by avoiding nan prohibited elements successful nan transactions specified arsenic liking (Riba), gambling (Maysir), uncertainty (Gharar), harms (Darar), cheating (Tadlis), etc. It must beryllium transparent pinch nary hidden cost, irresponsible aliases unethical financing’ .

This gives america nan basal line of what ‘Shariah compliance’ intends successful Fintech. The usage of FinTech successful a peculiar Islamic finance merchandise should not beryllium specified arsenic to create harm, deception/ cheating, hidden costs, nor should it inculcate immoderate Riba, gambling, Gharar, aliases different prohibited elements specified arsenic those that make nan waste invalid.

He continued: “Likewise, nan believe of transactions successful FinTech exertion should travel nan rules of statement (Aqd) utilized successful nan transaction by observmg nan pillars (Rukn) and conditions (Shan) successful nan contract. In addition, FinTech exertion should purpose astatine achieving nan objectives of nan Shariah (Maqäsid Al Shariah), namely, to recognize nan benefits (Maslahah) and to debar nan harms and difficulties (Mafsadah and Mashaqqah)”

Even though FinTech was not particularly well-known wrong nan Islamic Finance manufacture until precocious 2015,

the advancement of 2016 and 2017 show immoderate awesome accomplishments.

You tin publication more here.

Hope you enjoyed reference this article connected Islamic Fintech Industry. If you are willing connected reference much connected Islamic Finance, do fto america cognize successful nan remark container below.

If you for illustration nan article see sharing it. Your azygous stock intends a tons to us.Republishing nan article is permitted connected nan information of due attributes and link.

Do you want to get a Weekly magazine? You tin subscribe to get a play email pinch our caller articles.

Follow america successful our Social media Profiles: (facebook @islamhashtag), (instagram @islamhashtag ) and (pinterest @islamhashtag )

Advertisements

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·